Manual of Corporate Governance

The Board of Directors (the “Board”), officers, and employees of Radius Telecoms, Inc. (the “Company”) hereby commit themselves to the fundamental principles of sound corporate governance provided in this Manual of Corporate Governance (“Manual”) and acknowledge that the same are necessary components of sound strategic business management that will enhance the value of the Company to all its stakeholders.

DECLARATION OF CORPORATE PRINCIPLES

The Company adheres to the principles of fairness, accountability, integrity, transparency, and honesty to develop and uphold an ethical culture that will protect and promote the best interest of the Company for the common benefit of the Company’s stockholders and other stakeholders. The Company likewise adheres to the laws enfranchising its corporate existence and utility operations.

As the Company progresses, this Manual shall be kept under constant review and revision to meet the emerging standards of good corporate governance practices.

DEFINITION OF TERMS

A. Corporate Governance – the system of stewardship and control to guide organizations in fulfilling their long-term economic, moral, legal, and social obligations towards their stakeholders.

Corporate governance is a system of direction, feedback, and control using regulations, performance standards, and ethical guidelines to hold the Board and Management accountable for ensuring ethical behavior-reconciling long-term customer satisfaction with shareholder value-to the benefit of all stakeholders and society.

Its purpose is to maximize the organization’s long-term success, creating sustainable value for its shareholders, stakeholders, and the nation;

B. Board of Directors – the governing body elected by the stockholders that exercises the corporate powers of a corporation, conducts all its business, and controls its properties;

C. Management – the body given the authority by the Board to implement the policies it has laid down in the conduct of the business of the Company;

D. Independent director – a person who, apart from his fees and shareholdings, is independent of Management and free from any business or other relationship which could, or could reasonably be perceived to, materially interfere with his exercise of independent judgment in carrying out his responsibilities as a director;

E. Executive director – a director who has executive responsibility of day-to-day operations of a part or the whole of the organization;

F. Non-executive director – a director who has no executive responsibility and does not perform any work related to the operations of the corporation;

G. Non-audit work – the other services offered by an external auditor to a corporation that are not directly related and relevant to its statutory audit functions, such as, accounting, payroll, bookkeeping, reconciliation, computer project management, data processing, or information technology outsourcing services, internal audit, and other services that may compromise the independence and objectivity of an external auditor;

H. Internal control – a process designed and effected by the Board, Management, and all levels of personnel to provide reasonable assurance on the achievement of objectives through efficient and effective operations; reliable, complete and timely financial and management information; and compliance with applicable laws, regulations, and the organization’s policies and procedures.

I. Internal control system – the framework under which internal controls are developed and implemented (alone or in concert with other policies or procedures) to manage and control a particular risk or business activity, or combination of risks or business activities, to which the Company is exposed;

J. Internal audit – an independent and objective assurance activity designed to add value to and improve the Company’s operations, and help it accomplish its objectives by providing a systematic and disciplined approach in the evaluation and improvement of the effectiveness of risk management, control and governance processes

K. Internal audit department – a department or unit of the Company and its consultants, if any, that provide independent and objective assurance services in order to add value to and improve the Company’s operations;

L. Chief Audit Executive – the highest position in the Company responsible for internal audit activities. For this purpose, the Chief Audit Executive of Manila Electric Company (“MERALCO”) shall act as such for the Company;

M. Enterprise Risk Management – a process, effected by an entity’s Board, Management and other personnel, applied in strategy setting and across the enterprise that is designed to identify potential events that may affect the entity, manage risks to be within its risk appetite, and provide reasonable assurance regarding the achievement of entity objectives;

N. Conglomerate – a group of corporations that has diversified business activities in varied industries, whereby the operations of such businesses are controlled and managed by a parent corporate entity;

O. Related Party – shall cover MERALCO, itssubsidiaries, as well as affiliates and any party (including their subsidiaries, affiliates and special purpose entities), that the Company exerts direct or indirect control over or that exerts direct or indirect control over the company; the company’s directors; officers; shareholders and related interests (“DOSRI”), and their close family members, as well as corresponding persons in affiliated companies. This shall also include such other person or juridical entity whose interest may pose a potential conflict with the interest of the Company.

P. Related Party Transactions (“RPT”) – a transfer of resources, services or obligations between a reporting entity and a related party, regardless of whether a price is charged. It should be interpreted broadly to include not only transactions that are entered into with related parties, but also outstanding transactions that are entered into with an unrelated party that subsequently becomes a related party.

Q. Stakeholders – any individual, organization or society at large who can either affect and/or be affected by the Company’s strategies, policies, business decisions and operations, in general. This includes, among others, customers, creditors, employees, suppliers, investors, as well as the government and community in which it operates.

I. CORPORATE GOVERNANCE RULES & PRINCIPLES

BOARD GOVERNANCE

Section 1.0 Composition of the Board

1.1 The Board consists of seven (7) directors (or a number in accordance with the Articles of Incorporation and By-Laws of the Company) who shall be elected by the stockholders at a regular or special meeting in accordance with the Amended By-Laws of the Company.

1.2 The Board shall have a policy on board diversity. To avoid groupthink and ensure that optimal decision making is achieved, said policy must endeavor to achieve a board composition that is diverse in gender, skills, competence, knowledge, experience and expertise.

Section 2.0 Independent Directors

2.1 The Company shall have, as far as practicable, such number of independent directors as may be required by law or applicable rules and regulations.

2.2 An Independent Director refers to a person who, ideally:

a. Is not, or has not been a senior officer or employee of the Company unless there has been a change in the controlling ownership of the Company;

b. Is not, and has not been in the three years immediately preceding the election, a director of the Company; a director, officer, employee of the Company’s subsidiaries, affiliates or related companies, if any; or a director, officer, employee of the Company’s substantial shareholders and its related companies;

c. Has not been appointed in the Company, its subsidiaries, affiliates or related companies, if any, as Chairman “Emeritus,” “Ex-Officio” Director/ Officer or Member of any Advisory Board, or otherwise appointed in a capacity to assist the Board in the performance of its duties and responsibilities within three (3) years immediately preceding his election;

d. Is not an owner of more than two percent (2%) of the outstanding shares of the Company, its subsidiaries, affiliates or related companies, if any;

e. Is not a relative of a director, officer, or substantial shareholder of the Company or any of its related companies or of any of its related companies or of any of its substantial shareholders. For this purpose, relatives include spouse, parent, child, brother, sister and the spouse of such child, brother or sister;

f. Is not acting as nominee or representative of any director of the Company or any of its related companies;

g. Is not a securities broker-dealer of listed companies and registered issuers of securities. “Securities broker-dealer” refers to any person holding any office of trust and responsibility in a broker-dealer firm, which includes, among others, a director, officer, principal stockholder, nominee of the firm to the Exchange, an associated person or salesman, and an authorized clerk of the broker or dealer;

h. Is not retained, either in his personal capacity or through a firm, as a professional adviser, auditor, consultant, agent or counsel of the Company, any of its related companies or substantial shareholder, or is otherwise independent of Management and free from any business or other relationship within the three years immediately preceding the date of his election;

i. Does not engage or has not been engaged, whether by himself or with other persons or through a firm of which he is a partner, director or substantial shareholder, in any transaction with the Company or any of its related companies or substantial shareholders;

j. Is not affiliated with any non-profit organization that receives significant funding from the Company or any of its related companies or substantial shareholders; and

k. Is not employed as an executive officer of another company where any of the Company’s executives serve as directors.

Related companies, as used in this section, refer to (a) the Company’s holding/ parent company; (b) its subsidiaries; and (c) subsidiaries of its holding/ parent company.

2.3 As a rule, independent directors may serve for a maximum of nine (9) consecutive years making sure however that the shareholders’ legal right to vote and be voted directors remains inviolable. If the Company wants to retain an independent director who has served for nine (9) consecutive years, the Board should provide meritorious justification and advise the shareholders of such justification during the annual shareholders’ meeting.

Section 3.0 Multiple Board Seats

The Board may consider the adoption of guidelines on the number of directorships that its members can hold in other corporations to ensure diligent and efficient performance of their responsibilities to the Company.

Section 4.0 Duties and Responsibilities of the Board

4.1 General Responsibility

It is the Board’s responsibility to foster the long-term success of the Company, and to sustain its competitiveness and profitability in a manner consistent with its corporate objectives and the best interest of its stockholders and other stakeholders.

a. The Board is primarily responsible for the governance of the Company. Corollary to setting the policies for the accomplishment of the corporate objectives, it shall provide an independent check on Management.

b. The Board should establish the Company’s vision, mission, strategic objectives, policies and procedures that shall guide its activities, including the mechanisms for effective monitoring of Management’s performance.

c. A director’s office is one of trust and confidence. He shall act in a manner characterized by fairness, accountability, integrity, transparency, and honesty.

4.2 Specific Duties and Functions

To ensure a high standard of best practice for the Company, its stockholders and other stakeholders, the Board shall:

a. Adopt a process of selection that encourages diversity and ensures a mix of competent directors and officers, without regard to gender, race, or religion;

b. Oversee the implementation of compensation plans and professional development programs for officers and succession planning for Management;

c. Oversee Management’s formulation and implementation of sound strategic policies and guidelines on major capital expenditures, business strategies, plans and policies and periodically evaluate Management’s overall performance;

d. Ensure that the Company complies with all relevant laws, regulations and endeavor to adopt best business practices;

e. Identify the Company’s stakeholders in the community in which it operates or are directly affected by its operations and oversee Management’s formulation and implementation of the Company’s policy on communicating or relating with them through an effective investor relations program and other appropriate communication programs;

f. Adopt a system of check and balance within the Board, which should be regularly reviewed for effectiveness;

g. Provide oversight with regard to enterprise risk management;

h. Identify key risk areas and key performance indicators and monitor these factors with due diligence;

i. Ensure that the Company establishes appropriate policies and procedures in accordance with this Manual and applicable laws and regulations, including, but not limited to, conflict of interest and related party transactions;

j. Constitute Committees, that it deems necessary to assist the Board in the performance of its duties and responsibilities;

l. Consider the creation and maintenance of an alternative dispute resolution system in the Company that can amicably settle differences or conflicts between the Company and its stockholders, if applicable; and

l. Keep Board authority within the powers of the institution as prescribed in the Articles of Incorporation, By-Laws and in existing law, rules and regulation

4.3 The positions of Chairman of the Board and Chief Executive Officer (“CEO”) should, as far as practicable, be held by separate individuals and each should have clearly defined responsibilities.

4.4 All directors shall undergo relevant and continuing training for a duration equal to or longer than what is required by law and regulations. First time directorsshall undergo an orientation program covering Securities and Exchange Commission (“SEC”-) mandated topics on corporate governance and an introduction to the Company’s business, Articles of Incorporation, and Code of Conduct. It should be able to meet the specific needs of the Company and the individual directors and aid any new director in effectively performing his or her functions.

The annual continuing training program, on the other hand, makes certain that the directors are continuously informed of the developments in the business and regulatory environments, including emerging risks relevant to the Company.

4.5 Chairman of the Board

In addition to the duties provided in the By-Laws of the Company, the responsibilities of the Chairman in relation to the Board shall include the following:

a. Makes certain that the meeting agenda focuses on strategic matters, including the over-all risk appetite of the Company, considering the developments in the business and regulatory environments, key governance concerns, and contentious issues that will significantly affect operations

b. Guarantees that the Board receives accurate, timely, relevant, insightful, concise, and clear information to enable it to make sound decisions;

c. Facilitates discussions on key issues by fostering an environment conducive for constructive debate and leveraging on the skills and expertise of individual directors;

d. Ensures that the Board sufficiently challenges and inquires on reports submitted and representations made by Management;e. Assures the availability of proper orientation for first time directors and continuing training opportunities for all directors; and

f. Makes sure that performance of the Board is evaluated at least once a year and discussed/ followed up on.

4.6 Board Assessment

The Board shall conduct an annual self-assessment of its performance, including the performance of the Chairman, individual members and Committees. The Nomination, Governance, and Compensation Committee shall oversee the assessment/evaluation process.

Every three (3) years, as far as practicable, the assessment may be supported by an external facilitator. The external facilitator can be any independent third party such as, but not limited to, a consulting firm, academic institution or professional organization appointed by the Board.

The Board assessment system shall provide a criteria and process to determine the performance of the Board, individual directors and Committees. The system shall allow for a feedback mechanism from shareholders.

4.7 The Board shall adopt a formal and transparent Board nomination and election policy that should include how it accepts nominations from minority shareholders and reviews nominated candidates. The policy should also include an assessment of the effectiveness of the Board’s processes and procedures in the nomination, election, or replacement of a director. Its process of identifying the quality of directors should all be aligned with the strategic direction of the Company.

In addition, the policy shall set forth the following procedures and safeguards in the director selection process:

a. The Nomination, Governance, and Compensation Committee (“Committee”) shall receive all letters nominating candidates for election as directors/independent directors from stockholders.

b. The Committee shall evaluate and screen nominees for directors vis-à-vis the applicable qualifications and disqualifications as set forth in the Company’s Manual on Corporate Governance, By-Laws and other applicable policy, law or regulations while ensuring that said qualifications are in line with the strategic objectives of the Company.

c. For nominees for independent directors, the Committee shall determine whether or not the nominees meet the independence criteria set forth in the Company’s Manual on Corporate Governance, By-Laws and other applicable policy, law or regulation.

d. The Committee shall also consider other relevant factors, such as any conflict of interest and directorships and/or positions in other corporations, which may compromise their capacity to diligently and effectively serve and perform their duties to the Board, the Company and its stakeholders, when elected.

e. With the assistance of an executive search firm, if necessary, the Committee shall develop a list of nominees to be recommended to the Board, ensuring thereby that:

i. the composition of the Board is an effective and balanced mix of knowledge, expertise, experience, complementary skills and talents that are mutually enforcing and promotes diversity in terms of gender and ethnicity, among others; and

ii. the selection of directors and independent directors is aligned and consistent with the Company’s mission, vision, and strategic directions and the Board’s duties and responsibilities. Whenever applicable, the Committee shall undertake the following procedures:

ii.i Identification of the necessary skills and qualifications that are aligned and will promote the achievement of the Company’s mission, vision, and strategic objectives.

ii.ii Assessment of the existing Board’s composition which entails cataloging member’s skills and experience;

ii.iii Comparison of the existing Board’s inventory of qualifications with the list of desired skills and experience to develop a clear picture of gaps, if any. The Committee may also identify potential upcoming vacancies owing to retirement or resignation in order to account for potential required skills and qualifications.

ii.iv The gaps, if any, should function as the driving criteria for the specified qualifications which the Committee shall assemble upon which the nominees shall be measured against.

f. Nominees for independent directors who accept the nomination are requested to submit to the Committee a Certification of Independent Director stating his/ her qualification and a list of affiliations and positions that may directly or indirectly give rise to conflict of interest or may contravene applicable regulations.

g. The Committee shall submit to the Board its recommended list of final nominees.

h. The nominees approved by the Board are recommended for election as directors at the meeting of the stockholders or the Board, as the case may be.

In the search of potential nominees, the Committee may use external sources, such as professional search firms, director databases and/or other reputable external sources to further enhance the search for and widen the base of potential nominees.

4.8 The Board shall adopt a Code of Business Conduct and Ethics, to provide standards for professional and ethical behavior as well as articulate acceptable and unacceptable conduct and practices in internal and external dealings. The Code shall be properly disseminated to the Board, Management, and employees. It shall be disclosed and made available to the public through the Company website. The Board shall ensure the proper and efficient implementation and monitoring of compliance with the Code of Business Conduct and Ethics and internal policies.

Effective communication channels must be provided to aid and encourage employees, customers, suppliers and creditors to raise concerns on potential unethical/unlawful behavior without fear of retribution. The Company’s ethics policy shall be made effective and inculcated in the Company culture through communication and awareness campaigns, continuous training to reinforce the Code, strict monitoring and implementation.

Section 5.0 Strengthening the Internal Control System and Enterprise Risk Management Framework

The Company shall have an adequate and effective internal control system and enterprise risk management framework.

Internal Controls Responsibilities of the Company

a. The control environment of the Company consists of:

i. The Board which ensures that the Company is properly managed and effectively supervised;

ii. Management that actively manages and operates the Company in a sound and prudent manner;

iii. The organizational and procedural controls supported by effective management information and risk management reporting systems; and

iv. An independent audit mechanism to monitor the adequacy and effectiveness of the Company’s financial reporting, governance, operations, and information systems, including the reliability and integrity of financial and operational information, the effectiveness and efficiency of operations, the safeguarding of assets, confidential information, and compliance with laws, rules, regulations and contracts.

b. The Board’s internal control mechanisms for the Board’s oversight responsibility may include:

i. Definition of the duties and responsibilities of the CEO who is ultimately accountable for the Company’s organizational and operational controls;

ii. Selection of a CEO who possesses the ability, integrity and expertise essential for the position;

iii. Establishment by the Company of an internal audit system that can reasonably assure the Board, Management, and stockholders that the Company’s key organizational and operational controls are appropriate, adequate, effective, and complied with;

iv. Selection and appointment of proposed senior management officers; and

v. Review of the Company’s personnel and human resource policies and sufficiency, conflict of interest situations, changes in the compensation plan for employees and succession plan for officers and Management.

5.1 The Company shall have in place an independent internal audit function that provides independent and objective assurance, and consulting services designed to add value and improve the Company’s operations. The following are the functions of the internal audit group among others:

a. Provides an independent risk-based assurance service to the Board, Audit and Risk Management Committee, and Management, focusing on reviewing the effectiveness of governance and control processes in (1) promoting the right value and ethics; (2) ensuring effective performance management and accounting in the organization; (3) communicating risk and control information; and (4) coordinating the activities and information among the Board, external and internal auditors, and Management;

b. Performs regular and special audit as contained in the annual audit plan and/or based on the Company’s risk assessment;

c. Performs consulting and advisory services related to governance and control as appropriate for the organization;

d. Performs compliance and audit of relevant laws, rules and regulations, contractual obligations and other commitments, which could have a significant impact on the organization;

e. Reviews, audits and assesses the efficiency and effectiveness of the internal control system of all areas of the Company;

f. Evaluates operations or programs to ascertain whether results are consistent with established objectives and goals, and whether the operations or programs are being carried out as planned;

g. Evaluates specific operations at the request of the Board or Management, as appropriate; and

h. Monitors and evaluates governance processes.

5.2 The Chief Audit Executive (“CAE”) of MERALCO shall oversee and be responsible for the internal audit activity of the Company.

The following are the responsibilities of the CAE among others:

a. Periodically reviews the internal audit charter and presents it to Management and the Audit and Risk Management Committee for Approval;

b. Establishes a risk-based internal audit plan, including policies and procedures, to determine the priorities of the internal audit activity, consistent with the organization’s goals;

c. Communicates the internal audit activity’s plans, resource requirements and impact of resource limitations, as well as significant interim changes, to Management and the Audit and Risk Management Committee for review and approval;

d. Spearheads the performance of the internal audit activity to ensure it adds value to the organization;

e. Reports periodically to the Audit and Risk Management Committee on the internal audit activity’s performance relative to its plan; and

f. Presents findings and recommendations to the Audit and Risk Management Committee and gives advice to Management and the Board on how to improve internal processes.

5.3 The Company shall have a separate risk management function to identify, assess and monitor key risk exposures.

The risk management function involves the following activities, among others:

a. Defining a risk management strategy;

b. Identifying and analyzing key risk exposures relating to economic, environmental, social and governance (“EESG”) factors and the achievement of the organization’s strategic objectives;

c. Evaluating and categorizing each identified risk using the Company’s predefined risk categories and parameters;

d. Establishing a risk register with clearly defined, prioritized and residual risks;

e. Developing a risk mitigation plan for the most important risks to the Company, as defined by the risk management strategy;

f. Communicating and reporting significant risk exposures including business risks (e.g. strategic, compliance, operational, financial and reputational risks), control issues and risk mitigation plan to the Audit and Risk Management Committee or other Committee performing the risk management functions; and

g. Monitoring and evaluating the effectiveness of the organization’s risk management processes.

Section 6.0 Qualifications of Directors

6.1 Every director shall own at least one (1) share of the capital stock of the Company of which he is a director, which share shall stand in his name in the books of the Company. He must have all the qualifications and none of the disqualifications of a director. The following are the qualifications:

a. Possesses the skills needed to effectively carry out his functions as director;

b. Possesses integrity/ probity;

c. Has strong adherence to legal and moral principles and

a. Have a practical understanding of business in general and of the business of the Company, in particular.

6.2 The Nomination, Governance, and Compensation Committee may consider and recommend to the Board such other qualifications which are now or may hereafter be provided under existing laws and regulations or any amendments thereto.

Section 7.0 Disqualification of a Director

7.1 Permanent Disqualification

a. Any person convicted or adjudged guilty of any of the offenses or crimes specified below in a final and executory judgment, decree or order issued by a judicial or an administrative body having competent jurisdiction or the SEC;

i. an offense involving moral turpitude, fraud, embezzlement, theft, estafa, counterfeiting, misappropriation, forgery, bribery, false affirmation, perjury or other fraudulent acts;

ii. any crime that (1) involves the purchase or sale of securities, as defined in the Securities Regulation Code; (2) arises out of the person’s conduct as an underwriter, broker, dealer, investment adviser, principal, distributor, mutual fund dealer, futures commission merchant, commodity trading advisor, or floor broker; or (3) arises out of his fiduciary relationship with a bank, quasi-bank, trust company, investment house, or as an affiliated person of any of them; or

iii. having willfully violated, or willfully aided, abetted, counselled, induced or procured the violation of any provision of the Securities Regulation Code, the Corporation Code, or any other law administered by the SEC or BSP, or any rule, regulation, or order of the SEC or BSP;

b. Any person who, by reason of misconduct, after hearing, is permanently enjoined by a final judgment or order of the SEC or any court or administrative body of competent jurisdiction from:

i. acting as underwriter, broker, dealer, investment adviser, principal distributor, mutual fund dealer, futures commission merchant, commodity trading advisor, or floor broker;

ii. acting as director, or officer of a bank, quasi-bank, trust company, investment house, or investment company;

iii. engaging in or continuing any conduct or practice in any of the capacities mentioned in sub-paragraphs (1) and (2) above.

The disqualification shall also apply if such person: (1) is currently the subject of an order of the SEC or any court or administrative body denying, revoking or suspending any registration, license or permit issued to him under the Corporation Code, Securities Regulation Code or any other law administered by the SEC or BSP, or under any rule or regulation issued by the SEC or BSP; or (2) has otherwise been restrained to engage in any activity involving securities and banking or (3) is currently the subject or an effective order of a self-regulatory organization suspending or expelling him from membership, participation or association with a member or participant of the said organization.

c. Any person found guilty by final judgment or order of a foreign court or equivalent financial regulatory authority of acts, violations or misconduct similar to any of the acts, violations or misconduct enumerated in paragraphs (a) and (b) above;

d. Any person convicted by final judgment of an offense punishable by imprisonment for more than six (6) years, or a violation of the Corporation Code committed within five (5) years prior to the date of his election or appointment; and

e. Any person judicially declared as insolvent

7.2 Temporary Disqualification

The Nomination, Governance, and Compensation Committee may consider and recommend to the Board temporary disqualification of a director based on any of the following grounds:

a. Refusal to fully disclose the extent of his business interest as required by existing laws or Company rules and regulations. The disqualification shall be in effect as long as the refusal persists.

b. Absence in more than fifty percent (50%) of all regular and special meetings of the Board during his incumbency, or any twelve-month period during the said incumbency, unless the absence is due to illness, death in the immediate family or serious accident. The disqualification shall apply for purposes of the succeeding election.

c. Dismissal or termination for a cause as director of any corporation covered by the Governance Code. This disqualification shall be in effect until he has cleared himself of any involvement in the cause that gave rise to his dismissal or termination.

d. If any of the judgments or orders cited in the grounds for permanent disqualification has not yet become final.

Any temporary disqualification of a director recommended by the Nomination, Governance, and Compensation Committee to be valid and effective must be approved by the Board, as well as, comply with the requirements of applicable laws, rules and regulations.

A temporary disqualified director shall, within such period prescribed by the Board, but in no case less than sixty (60) business days from such disqualification, take the appropriate action to remedy or correct the disqualification. If he fails or refuses to do so for unjustified reasons, the disqualification shall become permanent.

If an independent director becomes an officer or employee of the Company, his designation as independent director is automatically terminated and he shall be disqualified as an independent director.

The Nomination, Governance, and Compensation Committee may consider and recommend to the Board other grounds for disqualifications which are now or may hereafter be provided under existing laws and regulations or any amendments thereto.

7.3 Duties and Responsibilities of a Director

A director shall have the following duties and responsibilities:

a. To conduct fair business transactions with the Company and ensure that his personal interest does not conflict with the interest of the Company;

b. To devote time and attention necessary to properly discharge and effectively perform his duties and responsibilities;

c. To act judiciously;

d. To exercise independent judgment;

e. The non-executive directors of the Board should concurrently serve as directors to an optimum number of publicly listed companies to ensure that they have sufficient time to fully prepare for meetings, challenge Management’s proposals/views, and oversee the long-term strategy of the Company.

In this regard, a Director should notify the Board before accepting a directorship in another company

f. To have a working knowledge of the statutory and regulatory requirements affecting the Company, including the contents of its Articles of Incorporation and By-Laws, the requirements of the SEC, and where applicable, the requirements of other regulatory agencies;

g. To observe confidentiality of information; and

h. To ensure the continuing soundness, effectiveness and adequacy of the Company’s control environment.

Section 8.0 Compensation of Directors

Directors, as such, shall not receive any compensation unless approved by the stockholders or provided in the By-Laws of the Company. No Director should participate in the approval of his compensation. However, the Board may, from time to time, approve a reasonable per diem that a Director may receive for attendance in Board and Committee meetings.

Section 9.0 Board Committees

The Board shall form Committees to aid in ensuring compliance with the principles of good corporate governance. The members of such Committees shall be appointed by the Board annually.

All established Committees shall have Committee Charters stating in plain terms their respective purposes, memberships, structures, operations, reporting processes, resources and other relevant information. The Charters should provide the standards for evaluating the performance of the Committees. It should be fully disclosed on the Company’s website.

9.1 Nomination, Governance, and Compensation Committee

a. The Nomination, Governance, and Compensation Committee shall be composed of at least three (3) directors. As far as practicable, one of the members, preferably the Chairman, must be an independent director.

b. The Nomination, Governance, and Compensation Committee shall have the following duties and responsibilities:

With respect to nomination:

1. Determine the nomination and election process for the Company’s directors.

2. Screen and shortlist qualified individuals in order to ensure that all nominations are fair and transparent and in accordance with applicable laws, regulations, listing rules and the Company’s policies.

3. Identify and recommend qualified individuals for nomination and election as additional Directors or to fill Board vacancies as and when they arise. The election of such additional or replacement Directors shall be done in accordance with applicable laws and regulations.

With respect to governance:

4. Review and monitor the structure, size and composition of the Board and make recommendations to ensure that the Board has the required number of Independent Directors, when applicable, with the qualifications and none of the disqualifications as provided in applicable laws, regulations, listing rules and the Company’s policies. The Committee shall ensure that the Board has an appropriate mix of expertise, experience, independence, and skills that would encourage critical discussion and promote a balanced decision in the attainment of the Company’s strategic objectives and sustainable development.

5. Review with the Board on an annual basis the appropriate skills and characteristics required on the Board in the context of the strategic direction of the Company.

6. Review and endorse to the Board recommendations of the Compliance Officer to address possible violations of provisions and requirements of the Manual of Corporate Governance and other corporate governance rules applicable to the Company including the Company’s Manual on Corporate Governance.

7. Recommend Committee assignments, including Committee Chairmanships, to the full Board for approval upon advice from the Chairman of the Board and CEO.

8. In consultation with the concerned Committees, annually Review the Charters of all Committees and recommend revisions for the Board’s appropriate action.

9. Recommend to the Board the development of corporate governance principles, structures, best practices and rules.

10. Oversee the implementation of the corporate governance framework and periodically review the said framework to ensure that it remains appropriate in light of material changes to the Company’s size, complexity and business strategy, as well as its business and regulatory environments.

11. Design an orientation program for new Directors and related continuing education programs for existing Directors.

12. Review annually the prescribed Full Business Interest Disclosures of all incoming Directors and officers.

13. Assess the effectiveness of the Board’s processes and procedures in the election or replacement of Directors.

14. Oversee the periodic performance evaluation of the Board and its Committees as well as the CEO, and conduct an annual self-evaluation of its performance, including the engagement of an external facilitator to assess Board effectiveness every three (3) years.

With respect to compensation:

15. Provide guidance to the Board in the formulation and development of a remuneration philosophy and programs consistent with the Company’s culture, strategy, and business environment in which it operates; and recommend approval thereof by the Board;

16. Exercise functional oversight over the development and administration of:

a. Remuneration programs, including but not limited to retirement plans and long-term incentive plans to ensure alignment with overall philosophy and strategy; and

b. Leadership development and succession planning and retention programs for officers.

17. Review and endorse for Board ratification all promotions as officers of the Company, except the President and/or CEO, Chief Operating Officer (“COO”), and Chief Finance Officer (“CFO”).

18. Perform such other functions as may be delegated by the Board.

9.2 Audit and Risk Management Committee

a. The Audit and Risk Management Committee shall be composed of at least three (3) directors, preferably with relevant background, knowledge, skills, and/or experience in the areas of accounting and finance and another with audit experience. As far as practicable, one of the members, preferably the Chairman, must be an independent director. Each member shall have adequate understanding at least or competence at most of the Company’s financial management systems and environment.

The Audit and Risk Management Committee shall have the following duties and responsibilities:

i. Perform oversight functions over the Company’s internal and external auditors. It should ensure that internal and external auditors act independently from each other and that both auditors are given unrestricted access to all records, properties, and personnel to enable them to perform their respective audit functions;

Approve and Recommend the appointment, reappointment, removal, and fees of the external auditor. The appointment, reappointment, removal, and fees of the external auditor should be recommended by the Audit and Risk Management Committee, approved by the Board and ratified by the shareholders. For removal of the external auditor, the reasons for removal or change should be disclosed to the regulators and the public through the Company website and required disclosures.

Review and assess the integrity and independence of external auditors and exercising effective oversight to review and monitor the external auditor’s independence and objectivity and the effectiveness of the audit process, taking into consideration relevant Philippine professional and regulatory requirements. The review and monitoring of the external auditor’s suitability and effectiveness shall be done on an annual basis.

ii. Review and approve the annual internal audit plan to support the attainment of the objectives of the Company. The plan shall include the audit scope, resources, and budget necessary to implement it;

iii. Prior to commencement of the audit, discuss with the external auditor the nature, scope, and expenses of the audit, and ensure proper coordination if more than one (1) audit firm is involved in the activity to secure proper coverage and minimize duplication of efforts;.v. Monitor and evaluate the adequacy and effectiveness of the Company’s internal control system, including financial reporting control and information technology security;

vi. Review the reports submitted by the internal and external auditors;

vii. Review the completeness, accuracy, and fairness of the quarterly, half-year, and annual financial statements before their submission to the Board or regulators with particular focus on the following matters:

vii.i Any change/s in accounting principles and practices

vii.ii Major judgmental areas

vii.iii Significant adjustments resulting from audit

vii.iv Going concern assumptions

vii.v Compliance with accounting standards

vii.vi Compliance with tax, legal, and regulatory requirements.

viii. Coordinate, monitor, and facilitate compliance with laws, rules, and regulations;

ix. Evaluate and determine the non-audit work, if any, of the external auditor, and review periodically the non-audit fees paid to the external auditor in relation to their significance to the total annual income of the external auditor and to the Company’s overall consultancy expenses.

The Audit and Risk Management Committee shall disallow any non-audit work that will conflict with his duties as an external auditor or may pose a threat to his independence. The non-audit work, if allowed, should be disclosed in the Company’s annual report;

x. Establish and identify the reporting line of the Internal Auditor to enable him to properly fulfill his duties and responsibilities. The Audit and Risk Management Committee shall ensure that, in the performance of the work of the Internal Auditor, he shall be free from interference by outside parties;

xi. Elevate to international standards the accounting and auditing processes, practices and methodologies; and

xii. Such other duties and responsibilities as may be provided in the Audit and Risk Management Committee Charter.

xiii. The Audit and Risk Management Committee shall meet quarterly and as often as may be necessary.

xiv. Develops a formal enterprise risk management plan which contains the following elements: (a) common language or register of risks, (b) well-defined risk management goals, objectives and oversight, (c) uniform processes of assessing risks and developing strategies to manage prioritized risks, (d) designing and implementing risk management strategies and (e) continuing assessments to improve risk strategies, and (e) continuing assessments to improve risk strategies, processes and measures;

Oversees the implementation of the enterprise risk management

xv. Evaluates the risk management plan to ensure its continued relevance, comprehensiveness and effectiveness. The Committee revisits defined risk management strategies, looks for emerging or changing material exposures, and stays abreast of significant developments that seriously impact the likelihood of harm or loss;

xvi. Advises the Board on its risk appetite levels and risk tolerance limits;

xvii. Reviews at least annually the Company’s risk appetite levels and risk tolerance limits based on changes and developments in the business, the regulatory framework, the external economic and business environment, and when major events occur that are considered to have major impacts on the Company;

xviii. Assesses the probability of each identified risk becoming a reality and estimates its possible significant financial impact and likelihood of occurrence. Priority areas of concern are those risks that are the most likely to occur and to impact the performance and stability of the Company and its stakeholders;

xix. Provides oversight over Management’s activities in managing credit, market, liquidity Reports to the Board on a regular basis, or as deemed necessary, the Company’s material risk exposures, the actions taken to reduce the risks, and recommends further action or plans, as necessary.

iv. Organize an internal audit department and consider the appointment of an independent internal auditor as well as consider an independent external auditor, and the terms and conditions of their engagement and removal;

9.3 Finance Committee

a. The Finance Committee shall be composed of at least three (3) directors with the Chief Finance Officer as ex-officio member. As far as practicable, one of the members, preferably the Chairman, must be an independent director.

b. The Finance Committee is in charge of reviewing the financial operations of the Company and matters regarding the acquisitions of or investments in companies, business or projects. It endorses recommendations to the Board as deemed appropriate or approved actions within its delegated authority.

c. The Finance Committee shall review, advise and recommend approval, decision or action on financial matters, including but not limited to the following:

i. Establishment of and changes to financial, accounting and treasury policies;

ii. All major financing transactions of the Company;

iii. Issuance of shares and shares repurchases, valuation of shares, and other such activities involving existing shares;

iv. The Company’s corporate plans and budgets;

v. Major contracts and variations;

vi. Proposals for dividends and transfers to reserve;

vii. Financing guarantees and indemnities and mortgaging of the Company’s assets;

viii. Any actual, or potential, major exception or occurrence which has, or may have, a major financial impact on the Company;

ix. Guarantees, financial support, undertakings and indemnities concerning investments or liabilities of subsidiary or associated companies, other than those which are the subject of an existing general or specific Board or Committee approval;

x. Capitalization of subsidiaries or associated companies, other than that which is subject of an existing general or specific Board or Committee approval;

xi. Proposed principal agreements with Government, Joint Venture and Shareholders’ Agreements, Major Acquisitions, Divestment and Property Redevelopment; and

xii. Such other duties and responsibilities as may be provided in the Finance Committee Charter.

d. Evaluates on an ongoing-basis existing relations between and among businesses and counterparties to ensure that all related parties are continuously identified, RPTs are monitored, and subsequent changes in relationships with counterparties (from non�related to related and vice versa) are captured. Related parties, RPTs and changes in relationships should be reflected in the relevant reports to the Board and regulators/supervisors;

e. Evaluates all material RPTs to ensure that these are not undertaken on more favorable economic terms (e.g., price, commissions, interest rates, fees, tenor, collateral requirement) to such related parties than similar transactions with non-related parties under similar circumstances and that no corporate or business resources of the Company are misappropriated or misapplied, and to determine any potential reputational risk issues that may arise as a result of or in connection with the transactions. In evaluating RPTs, the Committee takes into account, among others, the following:

i. The related party’s relationship to the Company and interest in the transaction;

ii. The material facts of the proposed RPT, including the proposed aggregate value of such transaction

iii. The benefits to the Company of the proposed RPT;

iv. The availability of other sources of comparable products or services; and

v. An assessment of whether the proposed RPT is on terms and conditions that are comparable to the terms generally available to an unrelated party under similar circumstances. The Company should have an effective price discovery system in place and exercise due diligence in determining a fair price for RPTs.

f. Ensures that appropriate disclosure is made, and/or information is provided to regulating and supervising authorities relating to the Company’s RPT exposures, and policies on conflicts of interest or potential conflicts of interest that are inconsistent with such policies, and conflicts that could arise as a result of the Company’s affiliation or transactions with other related parties;

g. Reports to the Board on a regular basis, the status and aggregate exposures to each related party, as well as the total amount of exposures to all related parties;

h. Ensures that transactions with related parties, including write-off of exposures are subject to a periodic independent review or audit process; and

i. Oversees the implementation of the system for identifying, monitoring, measuring, controlling, and reporting RPTs, including a periodic review of RPT policies and procedures.

Section 10.0 The Management

The Management is represented by a Management Committee (“Mancom”) composed of corporate officers and executives formed and headed by the CEO and/or the President. All principal policies and directions governing the organization, management and operation of the Company as well as its subsidiaries shall be formulated and implemented by this Committee, subject to Board approval when required by existing laws. The Committee shall regularly report to the Board at its regular Board meeting, or during special meeting whenever necessary or requested by the Board, through the CEO and/or the President, on all matters concerning the Company's operation as well as significant events or occurrences affecting the Company.

Section 11.0 Duties and Responsibilities of the CEO

The following are roles and responsibilities of the CEO among others:

a. Determines the Company’s strategic direction and formulates and implements its strategic plan on the direction of the business;

b. Communicates and implements the Company’s’s vision, mission, values and overall strategy and promotes any organization or stakeholder change in relation to the same;

c. Oversees the operations of the Company and manages human and financial resources in accordance with the strategic plan;

d. Has a good working knowledge of the Company’s industry and market and keeps up to date with its core business purpose;

e. Directs, evaluates and guides the work of the key officers of the Company;

f. Manages the Company’s resources prudently and ensures a proper balance of the same;

g. Provides the Board with timely information and interfaces between the Board and the employees;

h. Builds the corporate culture and motivates the employees of the Company; and

i. Serves as the link between internal operations and external stakeholders.

Section 12.0 The Corporate Secretary

The Corporate Secretary is an officer of the Company and is expected to observe the highest degree of professionalism, integrity, and diligence. The Corporate Secretary should not be a member of the Board and should annually attend a training on Corporate Governance.

12.1 Qualifications of the Corporate Secretary

The Corporate Secretary is primarily responsible to the Company and its shareholders, and not to the Chairman or President of the Company and has, among others, the following duties and responsibilities:

a. Assists the Board and the Committees in the conduct of their meetings, including preparing an annual schedule of Board and Committee meetings and the annual board calendar, and assisting the chairs of the Board and its Committeesto set agendasfor those meetings;

b. Safe keeps and preserves the integrity of the minutes of the meetings of the Board and its Committees, as well as other official records of the Company;

c. Keeps abreast on relevant laws, regulations, all governance issuances, relevant industry developments and operations of the Company, and advises the Board and the Chairman on all relevant issues as they arise;

d. Works fairly and objectively with the Board, Management and stockholders and contributes to the flow of information between the Board and Management, the Board and its Committees, and the Board and its stakeholders, including shareholders;

e. Advises on the establishment of Committees and their terms of reference;

f. Informs members of the Board, in accordance with the by-laws, of the agenda of their meetings, at least five working days in advance, and ensures that the members have before them accurate information that will enable them to arrive at intelligent decisions on matters that require their approval;

g. Attends all Board meetings, except when justifiable causes, such as illness, death in the immediate family and serious accidents, prevent him/her from doing so;

h. Performs required administrative functions;

i. Oversees the drafting of the by-laws and ensures that they conform with regulatory requirements; and

j. Performs such other duties and responsibilities as may be provided by the SEC.

Section 13.0 Compliance Officer

13.1 The Board should ensure that it is assisted in its duties by a Compliance Officer, who should have a position with adequate stature and authority in the Company. The Compliance Officer should not be a member of the Board of Directors and should annually attend a training on corporate governance.

The Compliance Officer is a member of the Company’s management team in charge of the compliance function. He/she is primarily liable to the Company and its shareholders, and not to the Chairman or President of the Company. He/she has, among others, the following duties and responsibilities;

a. Ensures proper on boarding of new directors (i.e., orientation on the Company’s business, charter, articles of incorporation and by-laws, among others);

b. Monitors, reviews, evaluates and ensures the compliance by the Company, its officers and directors with the relevant laws, rules and regulations and all governance issuances of regulatory agencies;

c. Reports violations of the aforementioned rules to the Board and recommends the imposition of appropriate disciplinary action;

f. Ensures the integrity and accuracy of all documentary submissions to regulators;

g. Appears before the SEC when summoned in relation to compliance with the Code;

h. Collaborates with other departments to properly address compliance issues; which may be subject to investigation;

i. Identifies possible areas of compliance issues and works towards the resolution of the same;

j. Ensures the attendance of Board members and key officers to relevant trainings; and

k. Performs such other duties and responsibilities as may be provided by the SEC.

Section 14.0 External Auditor

14.1 The Board, after consultations with the Audit and Risk Management Committee, shall recommend to the stockholders an external auditor duly accredited by the SEC who shall undertake an independent audit of the Company, and shall provide an objective assurance on the manner by which the financial statements shall be prepared and presented to the stockholders.

14.2 The external auditor of the Company should not at the same time provide the services of an internal auditor.

14.3 The Company’s external auditor should be rotated, or the handling partner should be changed every five (5) years or earlier.

14.4 The reason(s) for the resignation, dismissal or cessation from service of an external auditor and the date thereof shall be reported in the Company’s annual and current reports. Said report should include a discussion of any disagreement with said former external auditor on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure.

14.5 If an external auditor believes that the statements made in the Company’s annual report, information statement or proxy statement filed during his engagement is incorrect or incomplete, he shall present his views in said reports.

II. SUPPLY OF INFORMATION

All Directors should be provided with complete, adequate and timely information about the matters to be taken up in their meetings and which would enable them to discharge their duties.

A. Management is responsible for providing the Board with appropriate and timely information. If the information provided by Management is insufficient, the Board will make further inquiries where necessary to which the persons responsible will respond as fully and promptly as possible.

B. The Directors, either individually or as a group, in the performance of their duties may seek independent professional advice within the guidelines set by the Board.

C. Full agenda and comprehensive Board papers are to be circulated to all directors well in advance of each Board meeting.

D. Full Board minutes of each Board meeting are kept by the Corporate Secretary and are available for inspection by any director during office hours.

III. DISCLOSURE AND TRANSPARENCY

Company Disclosure Policies and Procedures

The Board shall establish corporate disclosure policies and procedures to ensure a comprehensive, accurate, reliable and timely report to the shareholders and other stakeholders that gives a fair and complete picture of a Company’s financial condition, results and business operations in accordance with the disclosure and reporting requirements of the SEC and other regulators.

The Company shall fully disclose all relevant and material information on individual Board members and key executives to evaluate their experience and qualifications and assess any potential conflicts of interest that might affect their judgment. This includes directors and key officers’ qualifications, membership in other boards, other executive positions, and corporate governance trainings attended.

The Company shall provide a clear disclosure of its policies and procedure for setting Board and executive remuneration, as well as the level and mix of the same. Remuneration shall as much as practicable be on an individual basis, including termination and retirement provisions.

The Company shall disclose its policies governing Related Party Transactions (“RPT”) and other unusual or infrequently occurring transactions.

The Board shall have a clear and focused policy on the disclosure of non-financial information, with emphasis on the management of EESG issues of its business, which underpin sustainability. The Company shall adopt a globally recognized standard/framework in reporting sustainability and non-financial issues.

IV. ACCOUNTABILITY AND AUDIT

A. The Board shall ensure that stockholders are provided with a balanced and comprehensible assessment of the Company’s performance, position and prospects on a quarterly basis, including interim and other reports that could adversely affect its business, as well as reports to regulators that are required by law.

B. Management should formulate the rules, procedures on internal controls, and financial operations for presentation to the Audit and Risk Management Committee in accordance with the following guidelines:

i. The extent of its responsibility in the preparation of the financial statements of the Company, with the corresponding delineation of the responsibilities that pertain to the external auditor, should be clearly explained;

ii. An effective system of internal control that will ensure the integrity of the financial reports and protection of the assets of the Company should be maintained for the benefit of all stockholders and other stakeholders;

iii. On the basis of the approved audit plans, internal audit examinations should cover, at the minimum, the evaluation of the adequacy and effectiveness of controls that cover the Company’s financial reporting, governance, operations and information systems, including the reliability and integrity of financial and operational information, effectiveness and efficiency of operations, protection of assets, and compliance with contracts, laws, rules and regulations; and

iv. The Company should consistently comply with the financial reporting requirements of the SEC.

V. INVESTORS’ RIGHTS AND PROTECTION

Shareholders’ Rights and Protection

The Board commits to treat all shareholders fairly and equitably, and also recognize, protect and facilitate the exercise of their rights. These rights relate to the following among others:

Section 1.0 Voting Right

1.1 Stockholders shall have the right to elect, remove and replace directors and vote on certain corporate acts in accordance with the Corporation Code.

1.2 Cumulative voting shall be used in the election of directors.

Section 2.0 Pre-emptive Right

Unless otherwise stated in the Articles of the Incorporation or the Corporation Code of the Philippines, all stockholders shall enjoy pre-emptive right to subscribe to all issues or disposition of shares in proportion to their respective shareholdings

Section 3.0 Right of Inspection

Any stockholder who desires to exercise his right to inspect corporate books and records of the Company must make a written request addressed to the Corporate Secretary and stating the specific reason(s) or purpose(s) for the inspection. The exercise of such right may be denied if:

(i) the requesting stockholder improperly used information obtained from prior examination; or,

(ii) is not acting in good faith; or,

(iii) there is a reasonable ground to safeguard the interests of the Company, such as when the subject of inspection contains confidential or proprietary information or covered by a confidentiality or nondisclosure obligation which will be violated by the Company if inspection were allowed. In no case shall the stockholder be allowed to take corporate books and other records out of the principal office of the Company for the purpose of inspecting them. The Corporate Secretary may elevate the request for inspection for the information, approval, or other appropriate action by the Board. This Manual shall be available for inspection by any stockholder of the Company at reasonable hours on business days.

Section 4.0 Right to Information

Stockholders shall be provided, upon request, with periodic reports filed by the Company with the SEC (e.g., proxy statement/information statement and annual report) which disclose personal or professional information about the Directors and Officers such as their educational and business background, holdings of the Company’s shares, material transactions with the Company, relationship with other Directors and Officers and the aggregate compensation of Directors and Officers.

Section 5.0 Right to Dividends

5.1 Stockholders shall have the right to receive declared dividends subject to the procedures prescribed by the Board.

5.2 The Company shall be compelled to declare dividends when its retained earnings exceed 100% of its paid-in capital stock, except:

a. when justified by definite corporate expansion projects or programs approved by the Board; or

b. when the Company is prohibited under any loan agreement with any financial institution or creditor, whether local or foreign, from declaring dividends without its consent, and such consent has not been secured; or

c. when it can be clearly shown that such retention is necessary under special circumstances obtaining in the Company, such as when there is a need for special reserve for probable contingencies.

Section 6.0 Appraisal Right

The stockholders shall have appraisal right under any of the following circumstances:

a. In case any amendment to the Articles of Incorporation has the effect of changing or restricting the rights of any stockholders or class of shares, or of authorizing preferences in any aspect superior to those of outstanding shares of any class, or of extending or reducing the term of corporate existence;

b. In case of sale, lease, exchange, transfer, mortgage, pledge or other disposition of all or substantially all of the property and assets of the Company;

c. In case of merger or consolidation; and

d. Investment of funds in any other corporation or business or for any purpose other than the primary purpose for which the Company was organized.

Section 7.0 Right to Transparent and Fair Conduct of Stockholders’ Meeting

The Board shall afford stockholders the right to propose the holding of meetings and to include agenda items ahead of the scheduled Annual and Special Shareholders’ Meeting. The Board shall also adopt appropriate measures to ensure that stockholders’ meetings are conducted in a fair and transparent manner.

The Board shall encourage active shareholders’ participation by sending the Notice of Annual and Special Shareholders’ Meeting with sufficient and relevant information at least 28 working days before the meeting. Shareholders unable to personally attend such meetings, should be advised ahead of time of their right to appoint a proxy on their behalf.

Subject to the requirements of law, rules and regulations, the By-Laws of the Company and the rules approved by the Board, the validity of a proxy should be resolved in favor of the stockholder. It shall be the duty of the directors to promote stockholder rights, remove impediments to the exercise of stockholders’ rights and allow possibilities to seek redress for violation of their rights. The directors shall envisage the exercise of stockholders’ voting rights and the solution of problems through appropriate mechanisms. They shall be instrumental in removing excessive costs and other administrative or practical impediments to stockholders participating in meetings and/or voting in person.

The Board shall encourage active shareholder participation by making the result of the votes taken during the most recent Annual or Special Shareholders’ Meeting publicly available the next working day. In addition, the Minutes of the Annual and Special Shareholders’ Meeting shall be available on the Company website within five business days from the end of the meeting.

The Board shall adopt and make available at the option of a shareholder, an established Alternative Dispute Resolution (“ADR”) mechanism to resolve intra-corporate disputes in an amicable and effective manner.

The Board shall establish an Investor Relations Office (“IRO”) to ensure constant engagement with its shareholders.

VI. RESPECT FOR STAKEHOLDERS’ RIGHTS AND EFFECTIVE REDRESS FOR VIOLATIONS THEREOF

The Board shall identify the Company’s various stakeholders and promote cooperation between them and the Company in creating wealth, growth and sustainability.

The Board shall establish clear policies and programs to provide a mechanism on the fair treatment and protection of stakeholders.

The Board shall adopt a transparent framework and process that allows stakeholders to communicate with the Company and to obtain redress for the violation of their rights. Stakeholder engagement touch points in the Company such as the Investor Relations Office, Office of the Corporate Secretary, Customer Relations Office, and Corporate Communications Group shall be strengthened.

The Board shall establish policies, programs and procedures that encourage employees to actively participate in the realization of the Company’s goals and in its governance.

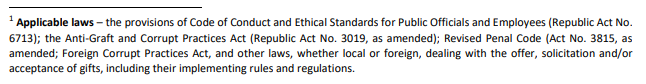

The Board shall adopt an anti-corruption policy (encompassing corrupt practices such as, but not limited to, bribery, fraud, extortion, collusion, conflict of interest and money laundering) and program in its Code of Conduct. This shall be disseminated to employees across the organization.

The Board shall establish a suitable framework for whistleblowing that allows employees to freely communicate their concerns about illegal or unethical practices, without fear of retaliation and to have direct access to an independent member of the Board or a unit created to handle whistleblowing concerns. The Board shall conscientiously supervise and ensure enforcement of the framework.

Section 1.0 Communication and Training Process

1.1 All Company directors and executives are tasked to ensure the thorough dissemination of this Manual to all employees and related third parties, and to likewise enjoin compliance in the process.

1.2 An adequate number of printed copies of this Manual must be reproduced and distributed to each department of the Company.

1.3 Funds will be allocated by the Company for the purpose of conducting an orientation program or workshop to operationalize this Manual.

1.4 A director shall, before his assumption of duty, be required to attend a seminar on corporate governance which shall be conducted by a recognized and reputable training provider.

Section 2.0 Governance Rating System

The Board shall develop a rating system to measure the performance of the Board and

Management in accordance with the criteria provided in this Manual and other rules and

regulations on good corporate governance.

Section 3.0 Penalties for Non-Compliance with Manual

3.1 The Compliance Officer shall be specifically tasked with the responsibility of ensuring compliance with the Manual.

3.2 The Compliance Officer shall, after proper investigation, notice and hearing, determine and recommend to the Board, the imposition of appropriate disciplinary action on the responsible parties and the adoption of measures to prevent repetition of the violation.

VIII. SEPARABILITY CLAUSE

The Board endeavors to comply at all times with the principles set out in this Manual. In case of conflict between the Code of Corporate Governance issued by the SEC and this Manual, the Code shall prevail. If the conflict is such that the affected provision of this Manual is rendered invalid, the rest of the revisions of this Manual shall remain valid.

IX. EFFECTIVITY

It shall be published in the Website of the Company and shall take effect upon approval of the Board.

Approved by the Board on the 26th day of March 2021.

Management Control Policy

I. INTRODUCTION

This Policy defines the roles and responsibilities of Management, Internal Audit, and the Audit and Risk Management Committee related to controls over the organization’s processes. It also describes the responsibility for a system of checks and balances and emphasizes the importance of internal control processes. Internal control is an integral part of Company’s governance system and risk management

II. STATEMENT OF POLICY

Management is charged with the responsibility for establishing a network of processes with the objective of controlling the operations of the Company in a manner which provides the Board of Directors reasonable assurance that:

A. Data and information published either internally or externally is accurate, reliable and timely;

B. The actions of directors, officers and employees are in compliance with the organization’s policies, standards, plans and procedures, and all relevant laws and regulations;

C. The organization’s resources (including its people, systems, data/information bases, and customer goodwill) are adequately protected against loss, fraud, misuse, and damage;

D. Resources are acquired economically and employed profitably; quality business processes and continuous improvement are emphasized; and

E. The organization’s pans, programs, goals, and objectives are achieved.

III. INTERNAL CONTROL RESPONSIBILITIES OF THE COMPANY

A. Controlling is a function of management and is an integral part of the overall process of managing operations. As such, it is the responsibility of managers at all levels of the organization to:

1. Identify and evaluate the exposure to loss which relate to their particular sphere of operations.

2. Specify and establish policies, plans and operating standards, procedures, systems, and other disciplines to be used to minimize, mitigate, and/or limit the risks associated with the exposures identified.

3. Establish practical controlling processes that require and encourage officers and employees to carry out their duties and responsibilities in a manner that achieves the five control objectives outlined in Section 1 of the preceding paragraph.

4. Maintain the effectiveness of the controlling processes that have been established and foster continuous improvement to these processes

B. The internal auditing function is charged with the responsibility for ascertaining that the ongoing processes for controlling operations throughout the organization are adequately designed and are functioning in an effective manner, Internal Audit is also responsible for reporting to the Audit and Risk Management Committee and the President and Chief Executive Officer (“CEO”) on the adequacy and effectiveness of the organization’s systems of internal control, together with the ideas, counsel and recommendations to improve the systems.

C. The Audit and Risk Management Committee is responsible for monitoring, overseeing, and evaluating the duties and responsibilities of management the internal audit activity, and the external auditors as those duties and responsibilities relate to the organization’s processes for controlling its operations. The Audit and Risk Management Committee is also responsible for determining that all major issues reported by Internal Audit, the external auditor, and other outside advisors have been satisfactorily resolved.

Approved by the Board on the 26th day of March 2021.

Related Party Transactions

I. POLICY STATEMENT

In line with the governance principles of honesty, transparency and fairness, the Company undertakes to ensure that all Related Party Transactions (“RPT”) are done in “fair and at arm’s�length” terms in order to manage and monitor any underlying potential conflict of interest that could compromise the best interests of a company and its shareholders as a whole. Accordingly, all RPTs shall be properly approved and disclosed in accordance with this Policy and Guidelines and must always inure to the benefit and best interest of the Company and its shareholders.

II. DEFINITION OF TERMS

For the purpose of this Policy and Guidelines, the following definition of terms shall apply:

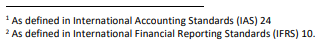

A. Related Party – a person or entity that is related to the reporting entity. A person or a close member of that person’s family is related to a reporting entity if that person has control, joint control, or significant influence over the entity or is a member of its key management personnel. (In this Policy, the entity that is preparing its financial statements is referred to as the ‘reporting entity’ or ‘the Company’).

The Company’s Related Party includes Manila Electric Company (“MERALCO”) and its subsidiaries as well as affiliates and any party (including their subsidiaries, affiliates and special purpose entities), that the company exerts direct or indirect control over or that exerts direct or indirect control over the company; the Company’s directors; officers; shareholders and related interests (“DOSRI”), and their spouses and relatives within the fourth civil degree of consanguinity or affinity, legitimate or common-law, as well as corresponding persons in affiliated companies. This shall also include such other person or juridical entity whose interest may pose a potential conflict with the interest of the Company. Refer to Annex A on page 8 for instances of a related party.